President Pam Discusses Visioning

President Pam Discusses VisioningOur Rotary District (District 5495) has a Visioning Committee. They work with individual Rotary Clubs to help them set a vision and establish action plans to reach their vision in 3-5 years. President Pam, President-Elect Robin Harris, and Logan Harper who will likely follow Robin are all on board with Mesa West Rotary going through the visioning exercise to set a clear direction for the coming years, and hopefully for the years to follow. Pam will soon be sending an e-mail to all active club members. We will be holding a visioning session in the near future. Dates being targeted are either Saturday, July 30 or Saturday August 6. Pam serves on the District Committee, but will be a participant rather than a facilitator for our Mesa West' visioning session. To be successful, it is very important that at least 50% of currently active members participate in the visioning exercise.

The invocation was offered by Darl Andersen and the pledge was led by Dan Lamborn. President Pam thanked Jay Stuckey for serving as greeter for the meeting.

Rotary Minute

A project very dear to Past District Governor David Simmer - the Navajo Water Project - is featured in the current issue of the Rotary Magazine. Pam assigned "homework" of opening our magazines and reading the article. If you've already passed your magazine on to another reader, CLICK HERE to read your homework.

Ace of Clubs Raffle - Steve Ross

Steve asked Dan Coons to draw the winning ticket, which was held by Darl Andersen. When Darl attempted to draw the Ace of Clubs, he instead drew the four of spades.

Happy Bucks - John Pennypacker

- John asked Jay Stuckey to explain his new name badge - Jay explained that his new badge showed his responsibility as Program Chair for this year. Jay said he does have programs booked through the first of October and asked members to let him know if there was something they would like to hear about or if they have individuals they can refer to present a program.

- John mentioned that Sue Gifford from Child Crisis Arizona would be presenting a program to our Club on October 13. Child Crisis Arizona recently received a $2,000 from the Mesa West Rotary Foundation which was very much appreciated.

- Lola McClane pledged $76 to the Mesa West Rotary Foundation. Her first day of life was 76 years ago Sunday July 3. She said she was an adult before she realized all the fireworks on her birthday were not for her. Ray Smith led everyone in singing "Happy Birthday" to Lola.

- Darl Andersen contributed his raffle winnings to the Mesa West Rotary Foundation to honor all the work Chuck Flint has done for the MWRF.

- Dick Myren pledged $2.00 for the privilege he and Honorary Member Rod Daniels enjoy of being part of Mesa West Rotary.

- Dan Coons pledged $5.00 for failing to prepare a parade or crowning ceremony to welcome Pam as our new Club President at our June 23 event. Dan had spent all his time preparing remarks celebrating accomplishments and thanking the members who made those accomplishments possible.

- Colleen Coons asked Dan if he wanted to ad $9 or $90 to his pledge to celebrate their nine-year anniversary July 5 (which Dan had failed to mention.) $9.00 was the amount pledged.

- Allan and Polly Cady were welcomed. They were attending from their boat in San Diego.

- Bert Millett pledged $5. He was glad to be back following over a month in Mexico with family.

- Bob Jensen was happy to report that Rudolfo Fernandez, down in Mexico, had a successful clinic. He saw 18 patients and issued 6 hearing aids. Nine of the patients seen were seen when we held our last clinic there in 2019. Two of them were twins. In 2019, the twins had developed their own language"twinspeak" and could only communicate effectively with each other. Bob said this is very common for twins when both are affected by hearing loss. At this recent clinic, it was apparent the twins are now communicating with others very well and are both doing well in school. Bob said it is hoped we will be able to put together a team to conduct a full clinic in November, 2022.

- Pam Cohen pledged $5 for getting to spend the weekend with her daughter, grandson, and step-granddaughter. She said it was hard to return to the heat of the valley after a weekend in Flagstaff. Pam thanked Dick Myren, Jack Rosenberg and Steve Ross for helping out at the front desk while Jeanie Morgan is in Michigan.

Announcements -

- Visioning Exercise - to take place July 30 or first Saturday in August. More information to follow.

- Ted Williams recently had quadruple bypass surgery. He is out and doing well. Pam encouraged members to send well wishes. CLICK HERE to send him an email message

- Lola McClane announced Brian Bausch who hosted our November 18 meeting at his ranch where Brian demonstrated some trick horseback riding skills, died as a result of a vehicle accident in June. Brian and his wife Paula had three children. Paula is due to give birth to a new baby mid-August. The memorial service for Brian will be held July 15. Brian is the son of one of Lola's high school friends in Kansas. Happy bucks donated in cash were given to Lola to donate to the "Go Fund Me" account established to help Brian's family following this unfortunate sudden loss. The bucket was passed so anyone present who wanted to donate cash could do so. If anyone would like to donate to the Go-Fund-Me account directly, CLICK HERE.

Program - Robbie Thompson - Medicaid Planning for Long Term Care

Jay Stuckey introduced our speaker, Robbie Thompson. As a recent transplant to Arizona, Robbie has worked in Medicaid Planning for the last four years. His dedication to helping seniors leave a legacy is a priority.

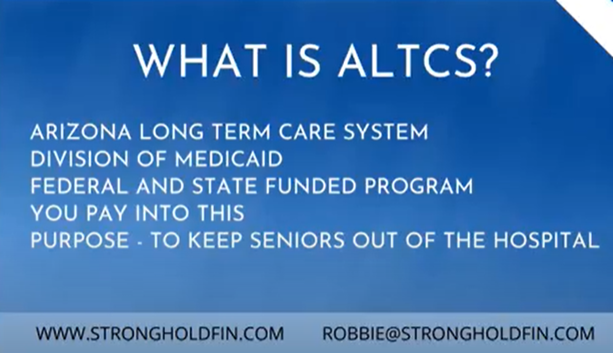

Jay Stuckey introduced our speaker, Robbie Thompson. As a recent transplant to Arizona, Robbie has worked in Medicaid Planning for the last four years. His dedication to helping seniors leave a legacy is a priority.Stronghold Financial specializes in Medicaid planning for long term care. The prevent their clients from having to spend down all their assets to be financially eligible for the Arizona Long Term Care System program (ALTCS).

No one is "too rich" for this program. Stronghold can protect 100% of the assets for the healthy spouse in a married couple, and 50-75% of the assets for the kids of an unmarried individual while qualifying the individual in need of care for the ALTCS program at the same time.

Robbie began by saying he was just going to cover the very basics of ALTCS. As the business development officer for Stronghold Financial, Robbie goes around educating people on the ALTCS program. In the Mesa West presentation, he planned to explain the medical requirements and the financial requirements. If time allowed, he planned to also share some examples.

Robbie began by saying he was just going to cover the very basics of ALTCS. As the business development officer for Stronghold Financial, Robbie goes around educating people on the ALTCS program. In the Mesa West presentation, he planned to explain the medical requirements and the financial requirements. If time allowed, he planned to also share some examples.Robbie said every state is unique. Their staff knows how to navigate the system. If they are given the authority to represent the patient/family, the odds of being approved are higher and the speed with with a decision is rendered is much better.

There is a lot of confusion about eligibility for the ALTCS program. Some of the confusion comes from the fact that it is associated with Medicaid. To qualify for Medicaid, one cannot have more than $2,000 in assets. Robbie said we have paid into ALTCS our entire adult lives and are entitled to those benefits. The purpose is to keep seniors out of the hospital. He said if your income is $1,000/month and cost of long-term care is $5,000, ALTCS will pick up remaining $4,000. Robbie said the average cost of care in a nursing home is $8,000/month.

There is a lot of confusion about eligibility for the ALTCS program. Some of the confusion comes from the fact that it is associated with Medicaid. To qualify for Medicaid, one cannot have more than $2,000 in assets. Robbie said we have paid into ALTCS our entire adult lives and are entitled to those benefits. The purpose is to keep seniors out of the hospital. He said if your income is $1,000/month and cost of long-term care is $5,000, ALTCS will pick up remaining $4,000. Robbie said the average cost of care in a nursing home is $8,000/month. Robbie said medically qualifying for ALTCS depends on the patient's ability to handle the activities of daily living (ADL): mobility, transferring, bathing, dressing, eating, grooming and toileting. Ability to manage each ADL is scored on a point system. In any single activity, if the patient is able to handle it independently, they score zero points. If they need supervised care for that activity, they score 5 points. If hands-on care is required, the score is 10 points. The total score for all seven ADLs must exceed 60 to medically qualify for ALTCS. A diagnosis of dementia or Alzheimer's is an automatic 20-point score.

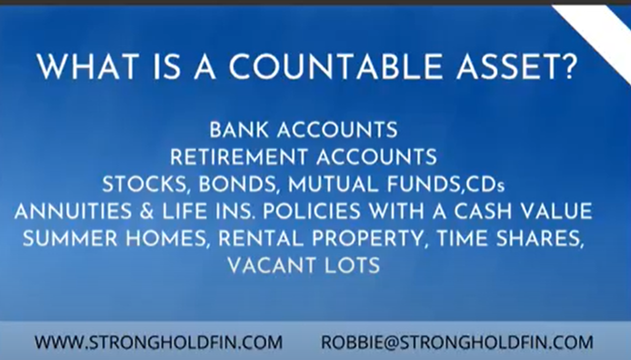

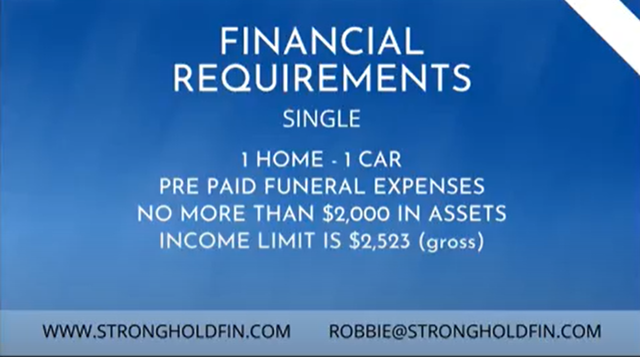

Robbie said medically qualifying for ALTCS depends on the patient's ability to handle the activities of daily living (ADL): mobility, transferring, bathing, dressing, eating, grooming and toileting. Ability to manage each ADL is scored on a point system. In any single activity, if the patient is able to handle it independently, they score zero points. If they need supervised care for that activity, they score 5 points. If hands-on care is required, the score is 10 points. The total score for all seven ADLs must exceed 60 to medically qualify for ALTCS. A diagnosis of dementia or Alzheimer's is an automatic 20-point score.To qualify financially, there are two areas they look at. There are income and asset limits. An individual can have one home, one car, no more than $2,000 in assets and $2523 gross in monthly income. With regard to the home, it can depend on who is living in the home at the time of the owner needing care. There are ways around some of these requirements and that is when a conversation with Stronghold might help.

It is easier to protect the assets of a married couple than it is for a single person. There are ways to protect the financial well-being of the healthy spouse.

It is easier to protect the assets of a married couple than it is for a single person. There are ways to protect the financial well-being of the healthy spouse. Countable assets are anything that can be cashed in for money.